LeverageD fi Strategy

Turbo charge your path to Financial Independence by using responsible leverage to bring forward future share distributions (income) and use this income to significantly reduce the loan repayments whilst also taking advantage of compounding and tax deductions on borrowings to further pay down the repayments.

How soon you reach Financial Independence all depends on how much effort you’re willing to put in to maximizing your savings, optimizing your spending and increasing your income. Reaching FI through leverage is the same but with the added option of paying off the loan as quickly as possible to significantly reduce the timeline to FI. The basic stages are outlined below as the slow, steady way but there is also a faster, riskier way which I’ll also go through. The workings for both will be expanded on further on down.

Keep in mind these stages only involve using the portfolio’s income, your tax returns and bonuses to pay down the loans. Once extra income/savings are diverted to paying down the loans with more urgency, you’ll very quickly annihilate the timelines for each stage.

Interest rate deductions, compounding and franking credit refunds are also ignored for simplicity but these will all increasingly add to the sweet, sweet honey pot as your portfolio grows. Similarly, reducing the LVR by paying down the loan is ignored.

This strategy can be a highly automated rinse and repeat system that is left to work on its own in the background once you’ve nailed down a few basics such as your savings rate, mindset and determination.

All calculations are made using a 7% NAB EB rate but the actual rate is currently sitting at 6.25%

Even in raising the rate to 10%, the timelines surprisingly all stayed very much the same

The Leveraged FI strategy can be best accomplished by using two specific instruments;

(1) The NAB Equity Builder

(2) Low cost broad based ETF’s (Vanguard, Betashares) or LIC’s

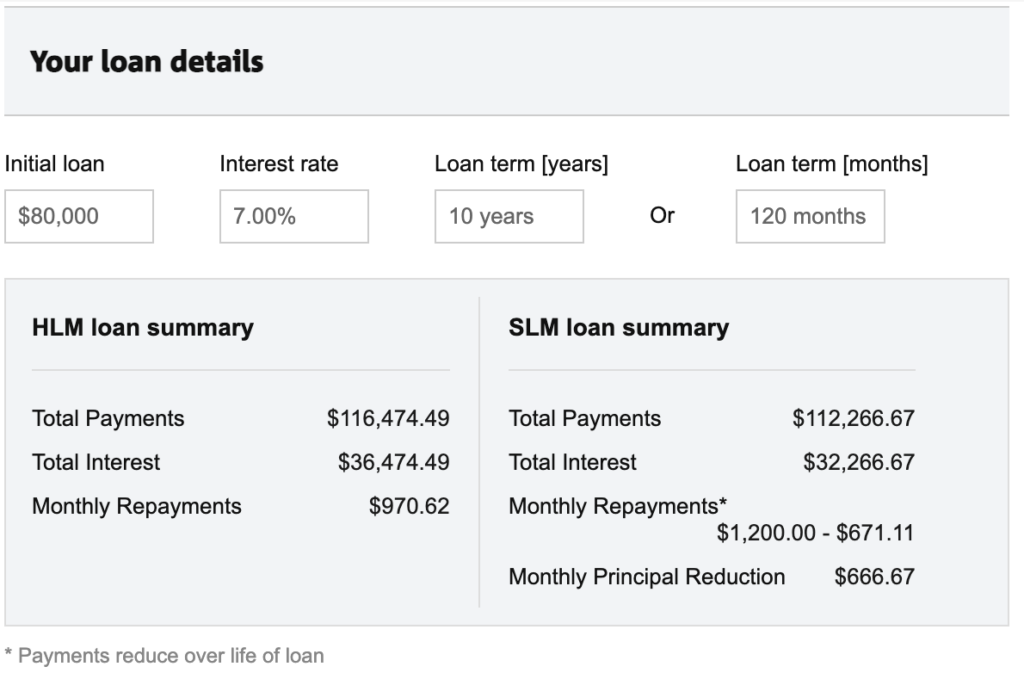

The NAB EB is a product that is essentially like a mortgage for shares- you can put a 20% deposit down to borrow up to 80% of the share value (Eg $20k cash or your own shares can help you leverage in to $100k worth of shares) and pay this back in the form of a Principal and Interest loan over 10 years.

The EB only allows you to buy ETF’s, LIC’s or Managed Funds as these are seen to be far safer than individual shares given that they cover hundreds of companies in just one share. For example, if you buy a single share of VAS, you’re buying the Top 300 Australian companies with instant diversity across all of the largest industries country wide.

Before beginning...

I am not a financial advisor and do not hold a financial licence. Any information contained within this website is purely for general information purposes only. Always do your own independent research when making financial decisions and if you require personal advice, seek professional financial advice.

Using leverage to increase debt may result in increased volatility and increased risk of loss.

Now that the fun stuff is out of the way, I’d like to impart some five core tenets to ensure your success with this strategy;

- You start small- borrow $50k to $100k to give an idea of market swings, repayments etc

- You have saved up enough to cover at least one year of loan repayments

- You have a separate emergency fund of at least 3 months living expenses, in cash

- You can (and will) stay the course for the medium to long term- at least 10 years minimum

- Thou shalt not sell, thou shall be very patient!

Stage 1- Leverage into $100k

If you’re new to share investing, it might take a little while to get your head around the figures but as you’ll find out, the numbers are the easy, straightforward part. It’s the emotions and mindset that are the hard part.

The assumption here is that you have saved up a full years worth of interest first to enable you to pay the monthly repayments without pressure. As share income can be lumpy, inconsistent and not paid monthly, it’s the best way to ensure you don’t miss any repayments.

Starting off with a small loan will give you decent exposure to the share market and an idea of how volatile it is. You will experience dips, crashes, corrections, bear markets etc that leads you to lose money. Some in the FI community with significant portfolios ‘lose’ $70k+ during such times but you have to understand that, in the long term, the share market will always go up.

The steps below outline the basics of the Leveraged FI process;

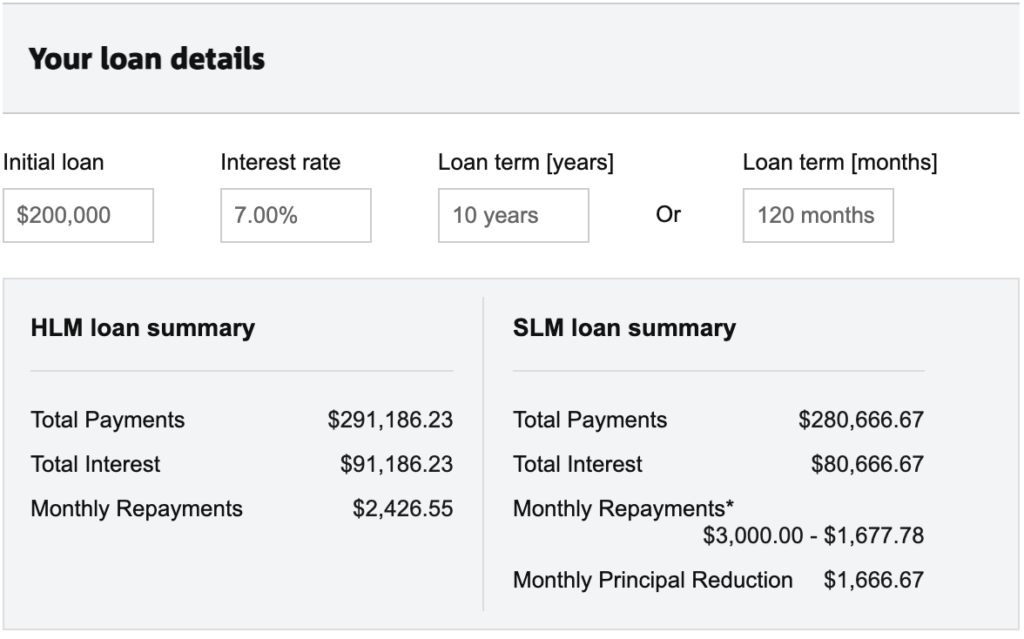

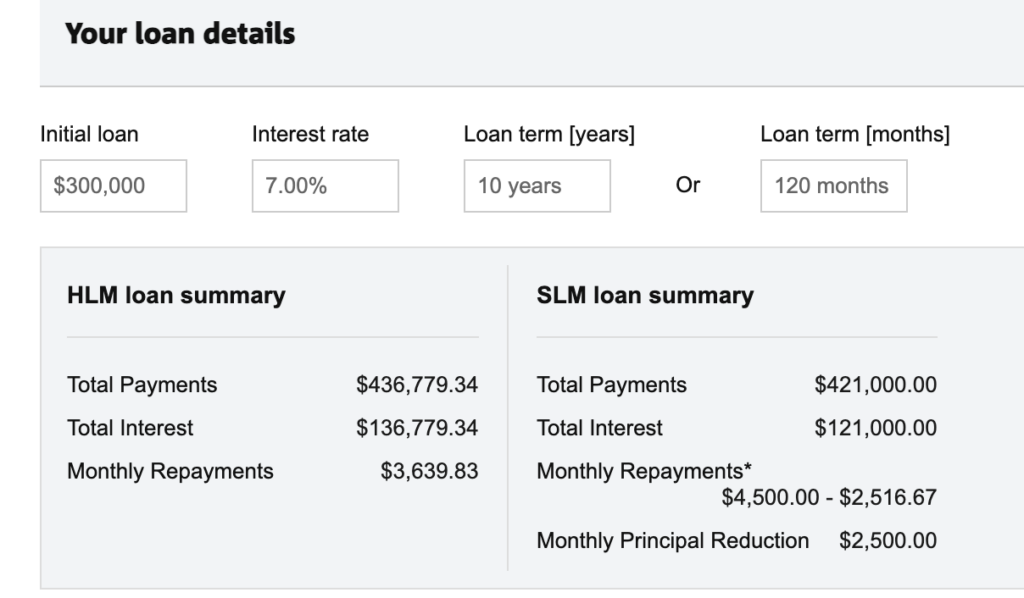

Stage 2- leverage into $300k

Stage 3- leverage into $600k

This is where things start to get very exciting and you begin to witness the true power of compounding in action!

Monthly repayments will now be quite high but you now should now be earning significant share income which will help drive down the repayments.

It may have taken 13 or so years to get here but you’re now in a truly excellent financial position without doing very much! Think about what you have achieved financially in the last 5,10,15 years. How much money do you have in the bank to show for all your hard work? If you’re the average Australian, it’s about $40k.

Now, whilst most would be happy with a $700k+ portfolio generating $28k per year, 13 years is just too long!

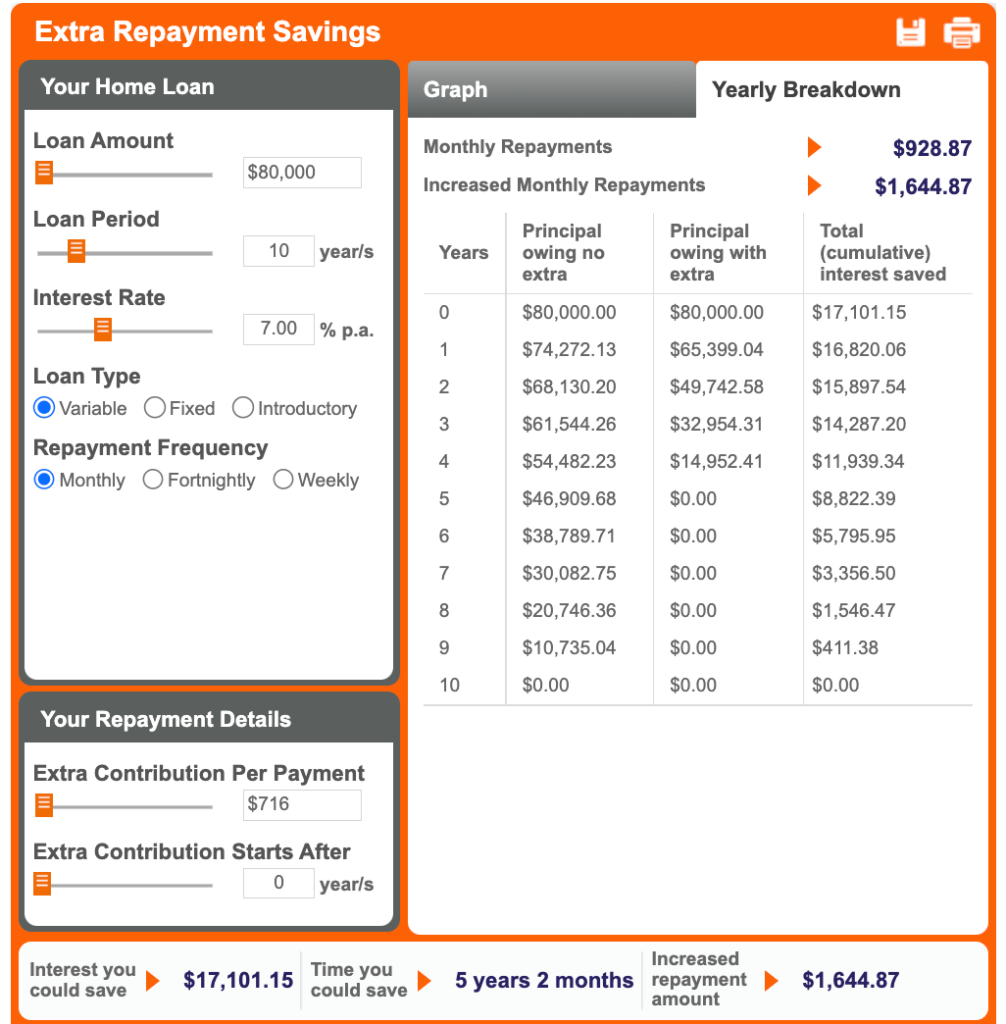

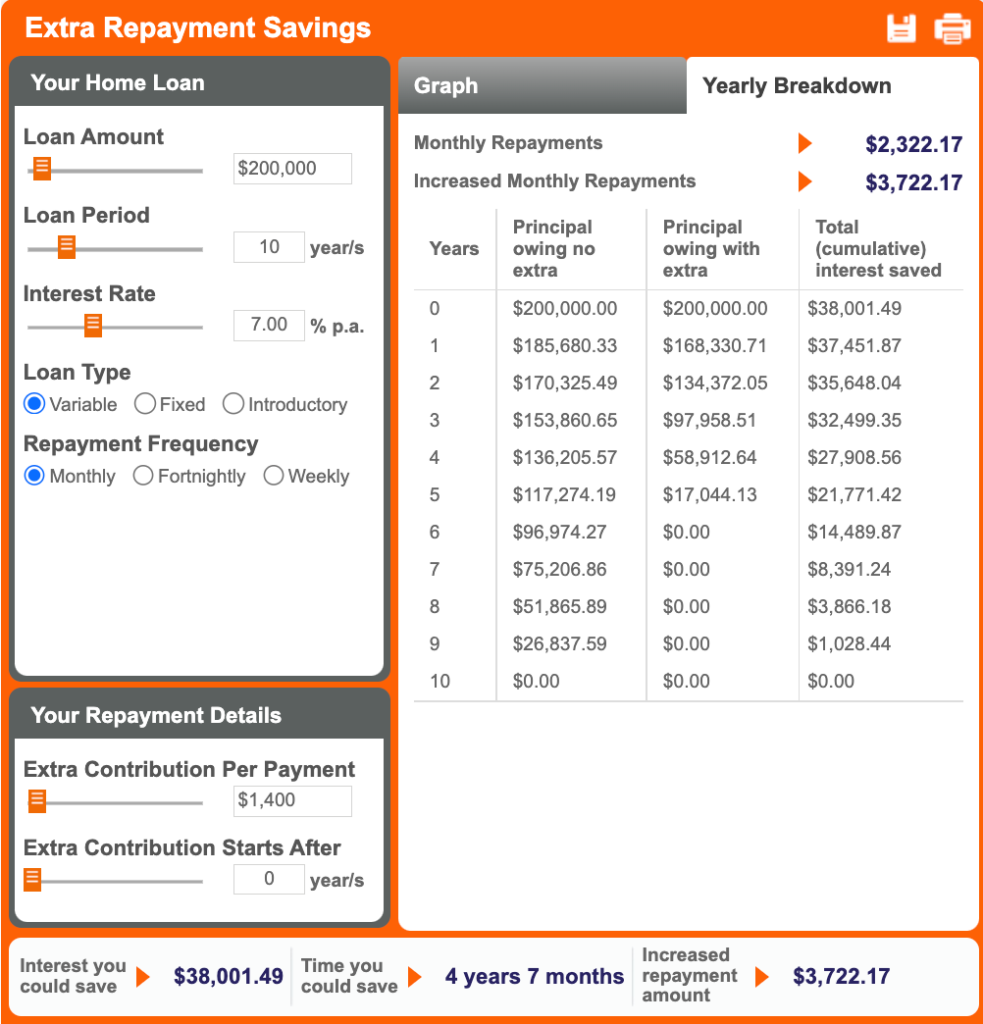

Therefore, there’s an extra stage for those who think that ‘good things also come to those who don’t want to wait’… the Extra Repayments Accelerator option. This is where you will sacrifice some of your disposable income to increase repayments and speed up the time to pay off the loans.

Stage 4- Extra repayments accelerator

Using only share income and redirecting your tax refunds and bonuses (a very small sacrifice) into each loan stage has so far helped you accumulate a decent portfolio in a fair amount of time. But nobody likes having debt, even if it is generating a nice little income and tax deductible! You should still endeavour to get rid of it as quickly as possible.

Remember, you haven’t put a single extra cent from your salary towards extra repayments this whole time.

Obviously everybody’s situation is different but most households should be able to spare $1.5k per month to put towards extra repayments… if so, you could smash through all the stages and pay off the whole $600k off in about 8 years!

This shows the awesome power of leverage as it would take me about 26 years to reach $600k if I were instead just buying $1.5k worth of shares every month.

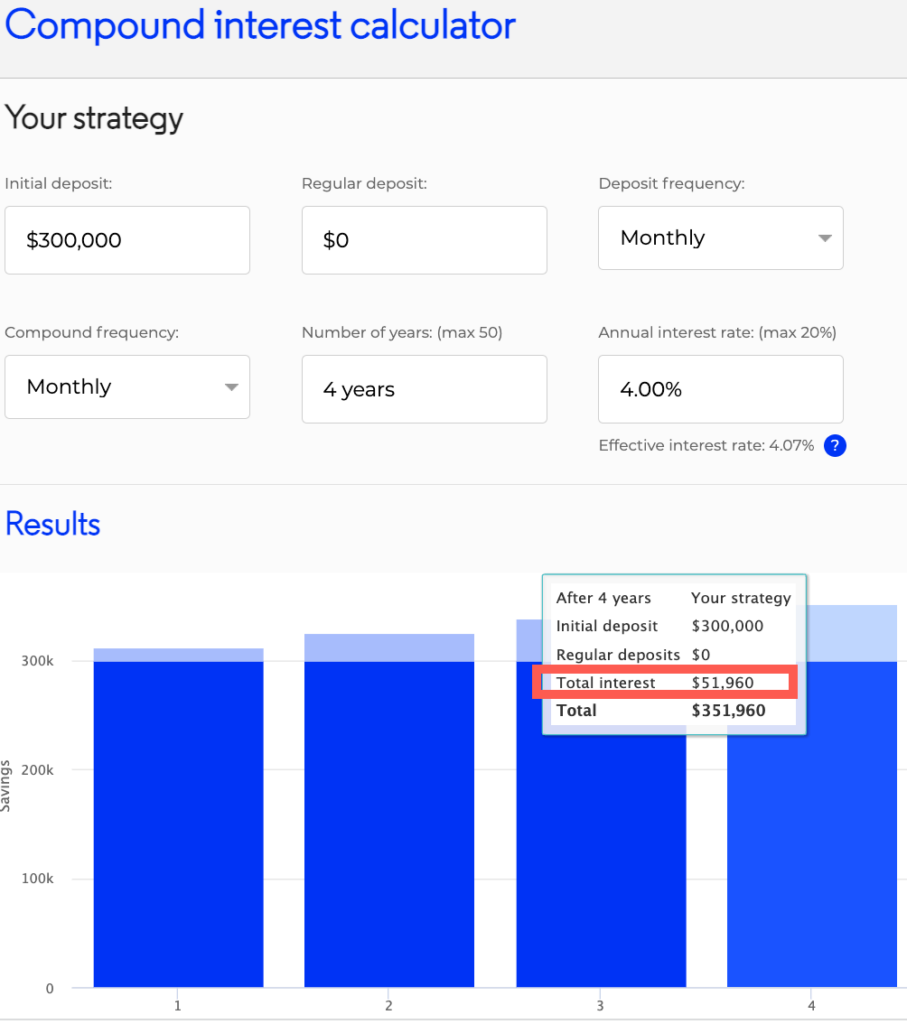

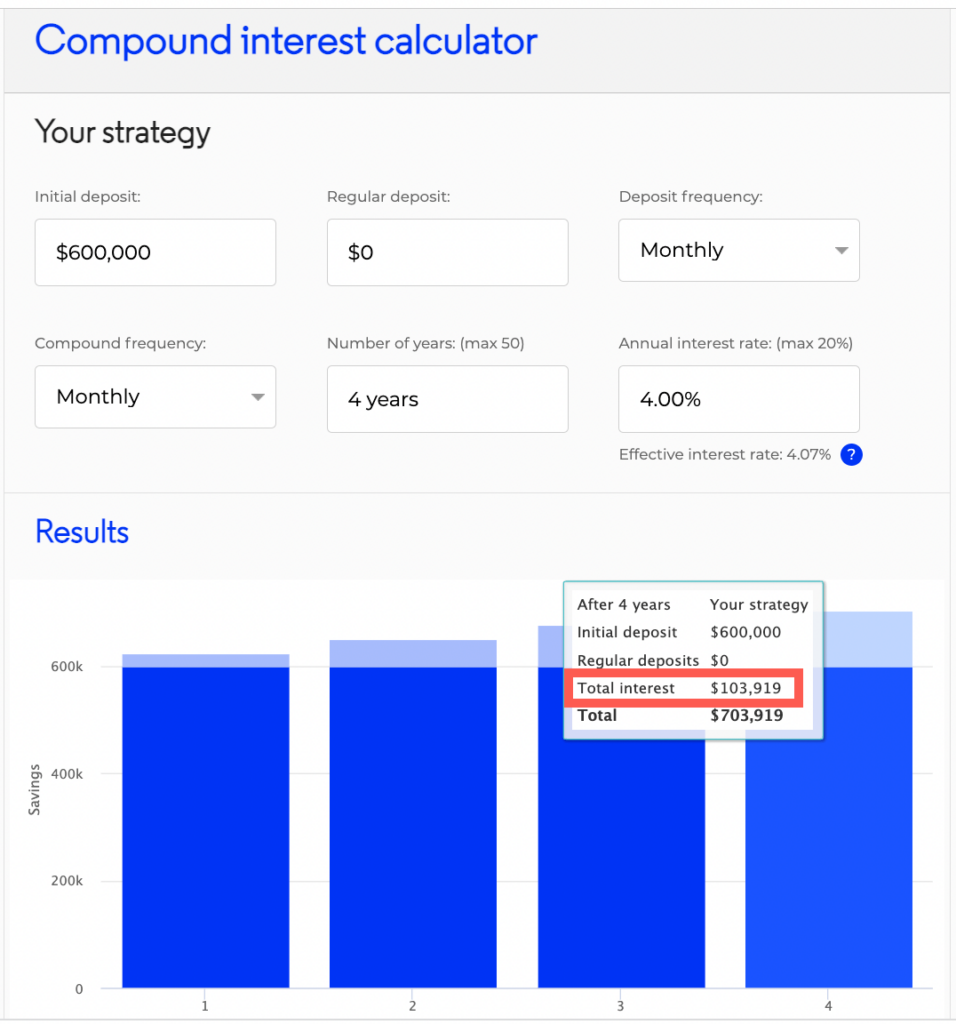

Even more incredible is that by the time you have paid off the $300k loan in that 6.5 years, the full $600k would have (assuming 4% growth) compounded to an astonishing $800k and generating a healthy $32k of income. Don’t know about you but that certainly makes my tail wag!

Stage 5

So now that you have worked hard to create a $600k portfolio in quite a short time, you have a few options that would not normally be available to you without such a significant nest egg;

Given that your portfolio is now most likely generating an impressive passive income of about $36k per year (4% yield on $900k) and depending on your expenses, there is the potential to move to Part Time work in an area you actually want to work in, keep up the social aspect of work and continue to receive Super contributions.

Mr Market and compounding will continue to work their magic in the background as you start to wind down and enjoy more freedom.

Maybe, like me, you actually don’t mind your job so you decide to continue enjoying the luxury of “working” from home and continue building the portfolio to increase my ‘F U Money’.

Or, and this is something I’m thinking I’ll do, you could decide that you want to go all out balls to the wall and further leverage upto $1m and using the same extra repayment strategy as Stage 4, you could be a passive millionaire in less than 4 years.

So there you have it, a faster way to reach Financial Independence with not all too much sacrifice or effort.

But then I thought… could this journey but sped up even more? Depending on where the market is and/or going… it could be!

Use Capital Growth to ACCELERATE the timeline to fi

This suggestion may be a little bit controversial but as there is the potential to get to the end goal even faster, it’s worth a mention.

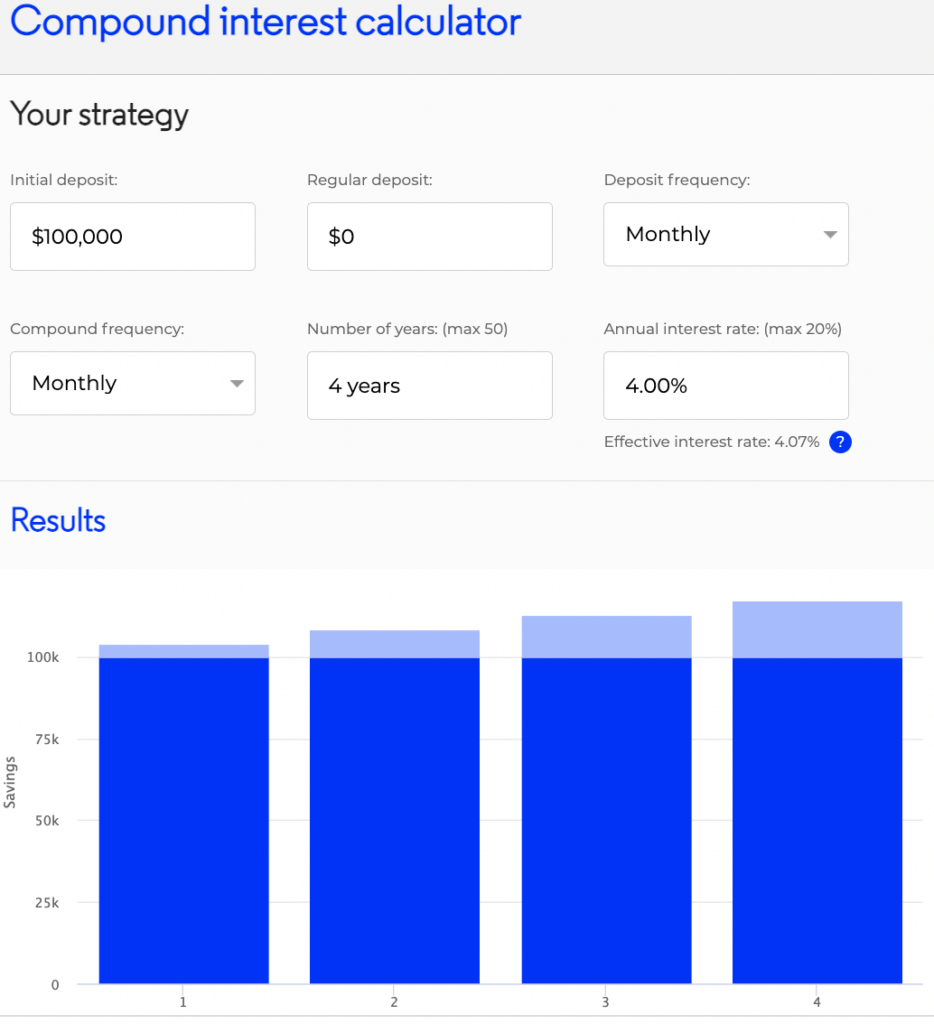

Researching the average return for the ASX provided various numbers depending on what year you start to calculate from (6% up to 13%) so once again for simplicity I’ll assume 10% compounded growth every year comprising of 6% growth and 4% yield. Mr Market will conveniently return the exact same result every year just for illustration purposes.

Given the repayments for the Stage 4 $300k loan are a massive $3,485/m but compounding is at it’s most significant, it’s a perfect place to employ the following strategy.

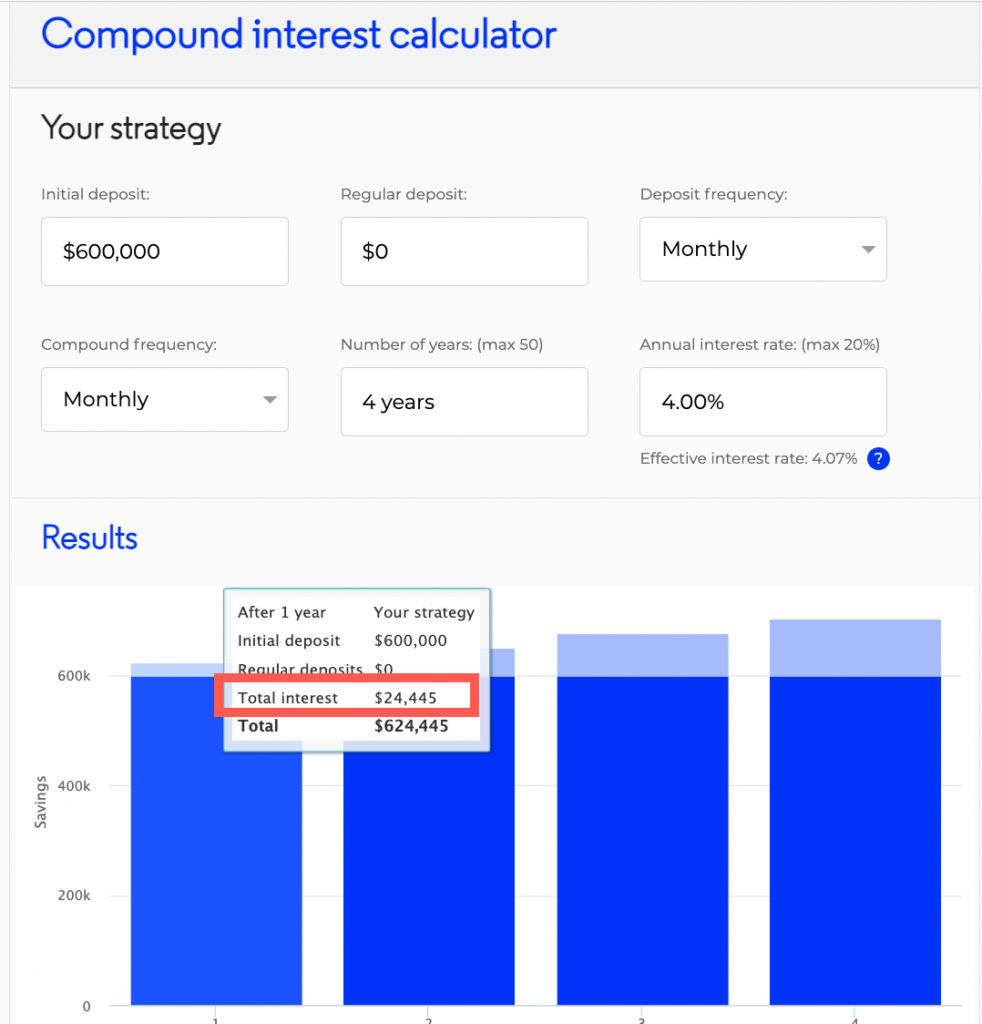

From the Aus Gov compounding calculator results below, you can see that the $600k would return $24.5k of capital gains after just 1 year at 4% growth;

Keeping the 50% CGT discount in mind, you could sell $24k worth of shares after 366 days. Using the CGT tax calc and the average Australian wage of $90k, tax payable would be $6k. Leaving you with an $18k net profit.

This $18k is then put towards extra repayments, further increasing your repayments to an impressive $4k per month. Doing this for each successive year will pay off the full $300k in.. drumroll…. 3.5 years!

Yes it eats into your asset base, yes there is CGT to pay (meaning lost future growth and income) and yes it’s very market dependent but it’s a very short term strategy with significant benefits that, in my opinion at least, is worth consideration if the market returns are in your favour.

So WHY THE NAB EQUITY BUILDER?

The NAB EB mitigates a lot of the risk I see associated with traditional forms of share leveraging for various reasons, these primarily being;

• It’s generally a 10 year P&I loan. As you’re forced to pay off the Principal part, you’re increasing your equity

• It only allows you to borrow against broad based ETFs, LICs or Managed Funds and not individual stocks, thus significantly reducing risk

• Currently the lowest interest rate for leveraged borrowing

• CHESS sponsored (you own the shares)

• Like a mortgage, you’re forced to make repayments so you’re incentivized and motivated to pay it down ASAP

• No margin calls. A true benefit as there wont be a need to find cash to increase LVR for the next inevitable market crash

• Once your LVR is under 65% you can increase the loan term to 15 years to reduce repayments. Not that you’d do that.

• At 30% LVR you can apply for Interest Only

• You can redraw the amount you have already paid off and buy more shares, very helpful in a downturn

Of course, there are some Cons for the EB such as the below but I strongly believe the Pros certainly do outweigh the Cons, especially if you’re working hard to pay the loans off as quickly as possible. Examples include;

• If you lump sum the whole loan in one go, you wont be able to DCA to take advantage of a market that’s dropping

• Unlike a mortgage, you cant move the loan as it’s not portable

• If the rates increase, so do your repayments. There’s nothing you can do about this.

I’m sure there are other Cons that exist but these are the only ones I could find searching various websites and forums.

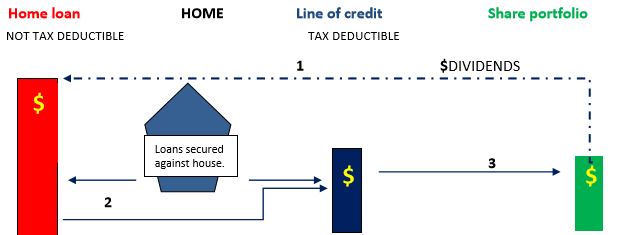

WHAT ABOUT DEBT RECYCLING?

Ideally the best way to buy income producing shares (which they must be to receive the tax deduction) is to use the non-deducible debt in your home and convert that ‘bad’ debt into ‘good’ tax deductible debt.

As I own the PPoR 50/50 with my partner and she has yet to come around to the idea that shares are actually a very good asset class to own (despite having 6 figures worth of shares in her Super!), debt recycling unfortunately is off the table for me for now.

According to Your Investment Property, homeowners in NSW have, on average, the highest equity levels at 56.6% and those in Victoria have about 49% equity. That’s a whole lot of money sitting around doing nothing!

Simply put, debt recycling is a more tax efficient way to invest than directly investing the same amount of money with your post-tax dollars.

Here’s a K.I.S.S example;

1. Your home is worth $1m with $600k still owing. You have saved $100k into your offset.

2. You ask the bank to split your $600k home loan into two to give you Split A for $500k and Split B for $100k.

3. You put the $100k that’s in the offset into Split B for all of 5 minutes and then transfer it to your brokerage account.

4. Interest on this $100k is now tax deductible.

5. Generally, the $100k should receive about $4k in dividends. At the current 3% rate, you can claim this as a $3k tax deduction (the interest on the $100k). For simplicity, I’ll use 50% as the tax rate so you’re now only paying tax on the remaining $1k of income -> $500.

Result: by debt recycling, you save $1,500 tax that year as opposed to not debt recycling. Nice win!

Tips;

- Ensure the splits are separate facilities set up as Interest Only so as to maximize your deductible interest.

- Do not deposit any other money into these splits.

- Borrowed funds should never be placed in an Offset account before being invested

- Read all of TerryW’s articles on Debt Recycling

Click here to see Peter’s full explanation of his method.

FURTHER INFORMATION ON THE NAB EB

Excellent in-depth interview by Aussie Firebug with someone who has used the NAB EB to bolster their returns with relative ease and take the portfolio up to $650k.

https://www.aussiefirebug.com/nab-equity-builder/

Another great write up on the EB with plenty of comments to get through

For anyone thinking of gearing into shares, I’ve written a review of NAB’s Equity Builder loan facility. from fiaustralia

FURTHER INFORMATION ON DEBT RECYCLING

The magnificent erudite of many forums, TerryW has written up hundreds of very helpful Tax Tips but his one on Debt Recycling is a must read

https://www.propertychat.com.au/community/threads/tax-tip-2-debt-recycling.1472/

AFB interviews TerryW in this very insightful podcast

https://www.propertychat.com.au/community/threads/tax-tip-2-debt-recycling.1472/https://podcasts.apple.com/au/podcast/59-terry-waugh-debt-recycling/id1080237514?i=1000569940081

Michael Yardney’s detailed explanation of Debt Recycling

Debt recycling: How to earn money from your debt

FURTHER INFORMATION ON using leverage to invest in shares

Essential listening about borrowing for share investing from two legends- Dave Strong Money and Pat the Shu

https://strongmoneyaustralia.com/podcast-using-debt-to-invest-in-the-sharemarket/