Networth

To hold myself accountable and ensure the path to FI is tracking well, I will update my net worth on a quarterly basis.

For most, the usual path to FI is a slow and consistent journey but with leverage and (in my eyes) reasonable $$$ sacrifices, it will help to significantly reduce the timeline so I can choose where I want to spend my time. It also cuts down on the common issue new FIRE starters encounter, that of Middle of the Road Boredom. Leveraged FI makes it a bit more exciting and achievable.

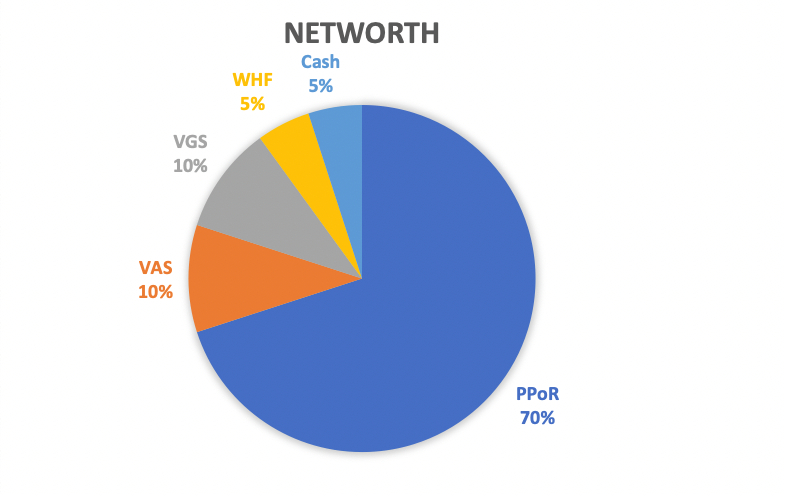

Having only discovered the concept of FI mid-2022 and buying our Sydney PPoR during the 2018 “peak”, the significant majority of the net worth consists of PPoR equity. By mid-2032, the aim is to have both almost equal at $1m+ each.

The overall plan is to pay off the $705k mortgage over the next 7 years whilst also leveraging up to a $500k share portfolio within the same timeframe. Whilst also raising two children. And throwing some Commercial property into the mix in about 3-4 years once enough PPoR equity is available. Talk about self-imposed pressure!

“FI is not only a possibility, but a mathematical certainty”- ChooseFI

Oct 2022

First net worth post and obviously very property heavy given the growth in Sydney over the last 5 years and only having bought three lots of index funds over the last three months.

Portfolio was originally only meant to consist of two funds (60/40 Vas and VGS) but the appeal of LIC’s kept haunting me (thanks to a certain Mr Thornhill) so decided to put a small amount into WHF and then, undecided as yet, AFIC or ARGO. Alternating between the two depending on how the NTA is trading.

Main goal is very simple- consistently pay down the NAB EB loan and mortgage.